Introduction

Renewable energy resources …

The impact of climate change is evident in today’s world, driven mainly by fossil fuels. The United Nations has stated that fossil fuels are the largest contributor to global climate change, responsible for over 75% of global greenhouse gas emissions and approximately 90% of all carbon dioxide emissions.

What is Renewable Energy Investing ?

With the increasing number of climate change and global warming incidents, many countries have started paying more attention to renewable energy investments. Renewable energy investments involve allocating financial resources to projects and technologies like solar, wind, hydropower, biomass, bioenergy, geothermal, and ocean energy.

Investments in these renewable energies aim to mitigate the risks of climate change and rely more on sustainable energy resources. This shift could lead to the development and growth of clean and sustainable energy solutions.

Why Invest in Renewable energy ?

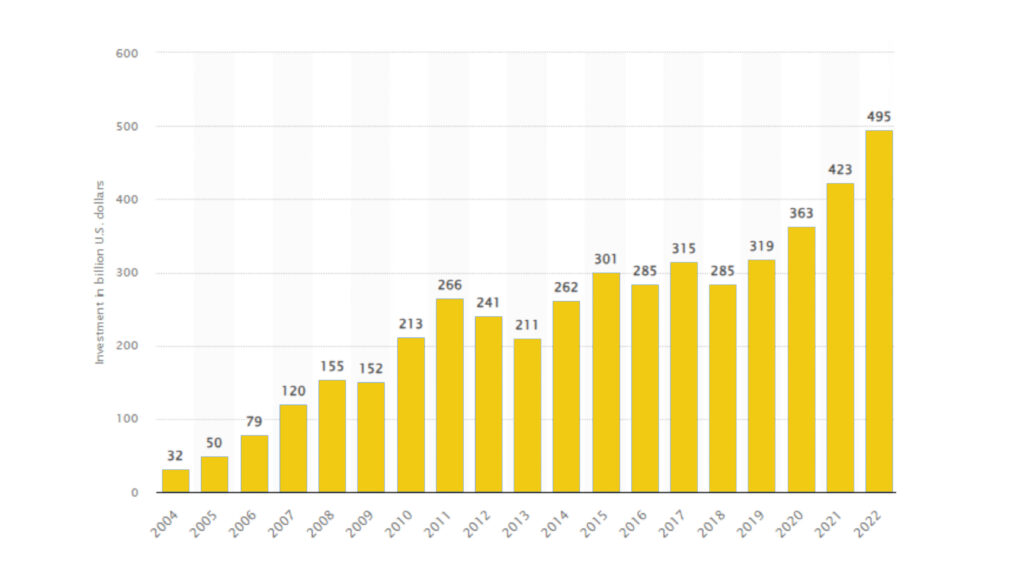

Sustainable energy investments and green projects can drive the global adoption of renewable energy. Data shows that investments in renewable energy worldwide reached $495 billion in 2022, up from $423 billion in 2021.

Sustainable Energy Investments Worldwide from 2004-2022

Source: Statista

1. Investing for a Sustainable Future

Statistics indicate that the adoption of renewable energy continues to grow. With increased investment and regulations to achieve net-zero emissions, the future is more likely to be sustainable.

2. Growth of the Sustainable Energy Sector

The renewable energy industry has been growing and could expand rapidly, potentially presenting lucrative investment opportunities. Due to the stability of renewable energy resources, investments in this sector could offer stable returns.

Types of Renewable Energy Investing

In 2018, 28% of global electricity was generated from renewable energy sources. Of that, 96% was produced from hydropower, wind, and solar technologies. The U.S. Energy Information Administration predicts that renewable energy will account for 49% of global electricity generation by 2050.

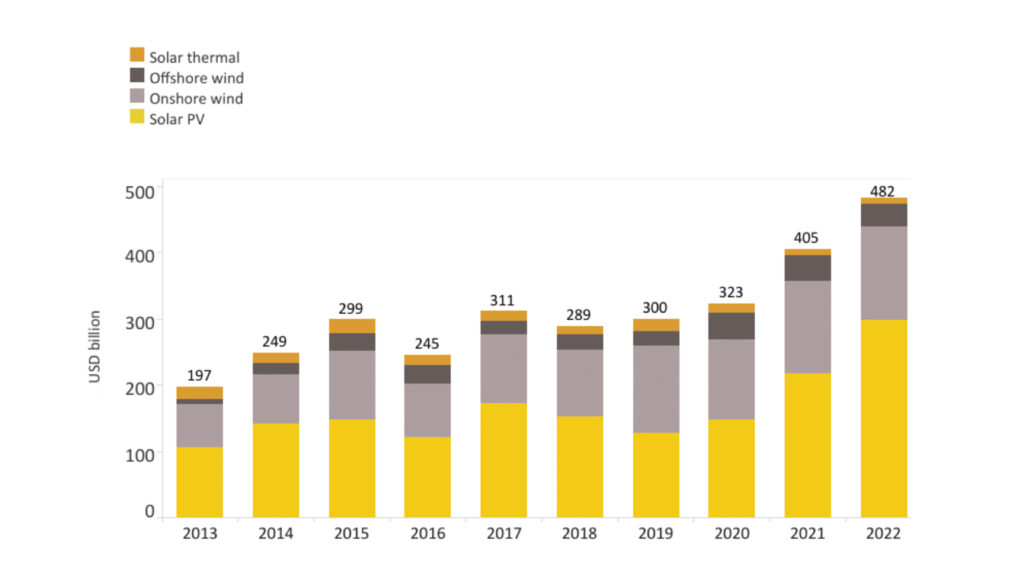

The chart below shows that during 2013-2022, solar PV and onshore wind attracted, respectively, 46% and 32% of global renewable energy investments.

Investments in Solar Energy

Solar energy is one of the most common sources of green energy. It can be harnessed by various technologies for residential and commercial applications. As technology advances, solar energy has become more affordable.

One method for generating electricity using solar energy is photovoltaics (PV). This method uses solar cells to convert sunlight into electricity through the photovoltaic effect.

PV solar panels

Statistics revealed that investments in solar and wind energy are by far the highest among other renewable energy resources. Investments in solar energy have increased significantly in recent years, rising from $126 billion in 2019 to approximately $300 billion in 2022.

Investments in Wind Energy

Wind energy is produced by converting the kinetic energy of moving air into electricity. This sector has grown rapidly since the start of the 21st century. Wind power is categorized as onshore or offshore.

Onshore and offshore wind turbines

The global installed wind generation capacity for both onshore and offshore wind has increased significantly in the past two decades. Data predicts that both onshore and offshore wind still have tremendous potential for improvement. Technological advancements have reduced the costs of generating renewable energy and increased capacity factors, leading to over $142 billion in new investments in wind energy in 2019.

How to Invest in Renewable Energy?

There are several ways to earn profits from green energy projects and invest in renewable energy sources. One of the leading renewable energy platforms is LumiPlace.

LumiPlace functions as an asset-backed NFT (non-fungible token) marketplace, offering an innovative solution for investing in sustainable green projects. By tokenizing these projects and fractionalizing the assets, LumiPlace democratizes access to investment opportunities in the renewable energy sector.

Key Benefits of Investing Through LumiPlace

1. Accessibility

LumiPlace facilitates access to renewable energy projects, making sustainable investment available to a broader audience. The platform tokenizes real-world assets with a focus on renewable energy projects, leading to easier access, affordable entry points, and increased liquidity.

2. Diversification

One of the most successful strategies for renewable energy investments is portfolio diversification. Investing in various renewable energy projects and technologies helps mitigate risks. Diversification is the most convenient way to increase the potential for higher returns on investment.

LumiPlace interface

With LumiPlace, investors have access to various investment opportunities in different sectors and countries. The platform seamlessly integrates real-time data from leading renewable energy providers, offering transparency and data-centric insights for informed decisions.

3. Transparency

LumiPlace prioritizes transparency by integrating real-time data from leading renewable energy providers. Investors have access to detailed information about each project, including performance metrics and environmental impact. This approach empowers investors to make informed decisions and monitor their investments closely.

4. Security

Investing through LumiPlace offers enhanced security. The platform employs blockchain technology to tokenize assets, providing a transparent and immutable record of transactions. This reduces the risk of fraud and ensures that investments are securely tracked. Additionally, LumiPlace adheres to strict regulatory standards, ensuring that investors’ interests are protected.

Conclusion

Sustainable energy investments contribute to combating climate change and promoting sustainable development. With the current global shift towards greener energy solutions, the renewable energy sector could offer promising investment opportunities. Platforms like LumiPlace democratize access to investment opportunities related to renewable energy projects, making it easier for investors. By adopting the strategies mentioned in the guide above, investors can start getting exposure to renewable energy projects and achieve their financial and environmental goals.

Frequently Asked Questions (FAQs)

Which renewable energy resource is best to invest in?

The best renewable energy resource to invest in depends on several factors, including market trends, geographical location, and technological advancements. Solar and wind energy have shown significant growth and investment returns in recent years. However, diversifying investments across multiple renewable energy sources can mitigate risks and enhance potential returns.

Is investing in renewable energy projects a good investment?

Investing in renewable energy projects can be a good investment due to several factors. The global push towards sustainable energy, supported by government policies and regulations, has created a favorable environment for renewable energy investments.

How do I start investing in sustainable energy projects?

Understand the different types of renewable energy sources and identify the ones that align with your investment goals, select a secure and transparent investment platform such as LumiPlace, diversify your investment portfolio across various projects, and seek advice from financial advisors to make informed decisions.

What strategies can investors adopt for successful green energy investments?

Investors can adopt several strategies for successful green investments, such as:

- Investing in a mix of renewable energy projects across different locations and technologies to spread risk.

- Utilizing renewable energy investment platforms such as LumiPlace offers access to diverse projects and provides transparency and data-driven insights.

Disclaimer: This guide is for informational purposes only and should not be construed as investment or financial advice. Always seek professional advice before making any investment decisions.

Leave a Comment