Introduction

The advent of blockchain and cryptocurrencies introduced the novel idea of decentralization. Decentralization, by definition, means that instead of having one single entity controlling something, a group of people own it. Banks, for instance, are centralized because they control how much money you can deposit, inquire about the source of this money, and determine how much you can send and receive.

Similarly, investments have traditionally been centralized, requiring high initial capital and being primarily accessible to institutional investors. However, the concept of real-world assets tokenization is poised to change that.

What is Tokenization ?

Two of the most flourishing industries today are blockchain technology and sustainable energy projects. Data shows that investments in clean energy technologies are expected to reach $800 billion in 2024 and $1 trillion by 2030. How can environmentalists and retail investors get involved in these billion-dollar investments? The answer is tokenization.

Tokenization is the act of creating a digital copy of a real-world item on the blockchain. Once these items exist on-chain, they are called real-world assets (RWA). Real-world assets refer to tangible and physical items that are tokenized for use on a blockchain.

Everything in the world could potentially be duplicated and brought on-chain; however, real-world assets most commonly refer to valuable items such as real estate, commodities, or collectible art. Another significant application of tokenization is in sustainable energy projects.

Why would we tokenize energy projects? Good question. Let’s have a look at the benefits of real-world assets tokenization.

Liquidity

Tokenizing assets, such as renewable energy investments, can enhance market liquidity. By issuing renewable energy tokens, buying, selling, and investing in these projects become more accessible to investors. Illiquid investments, which are not easily converted into cash, become more efficient through real-world assets tokenization.

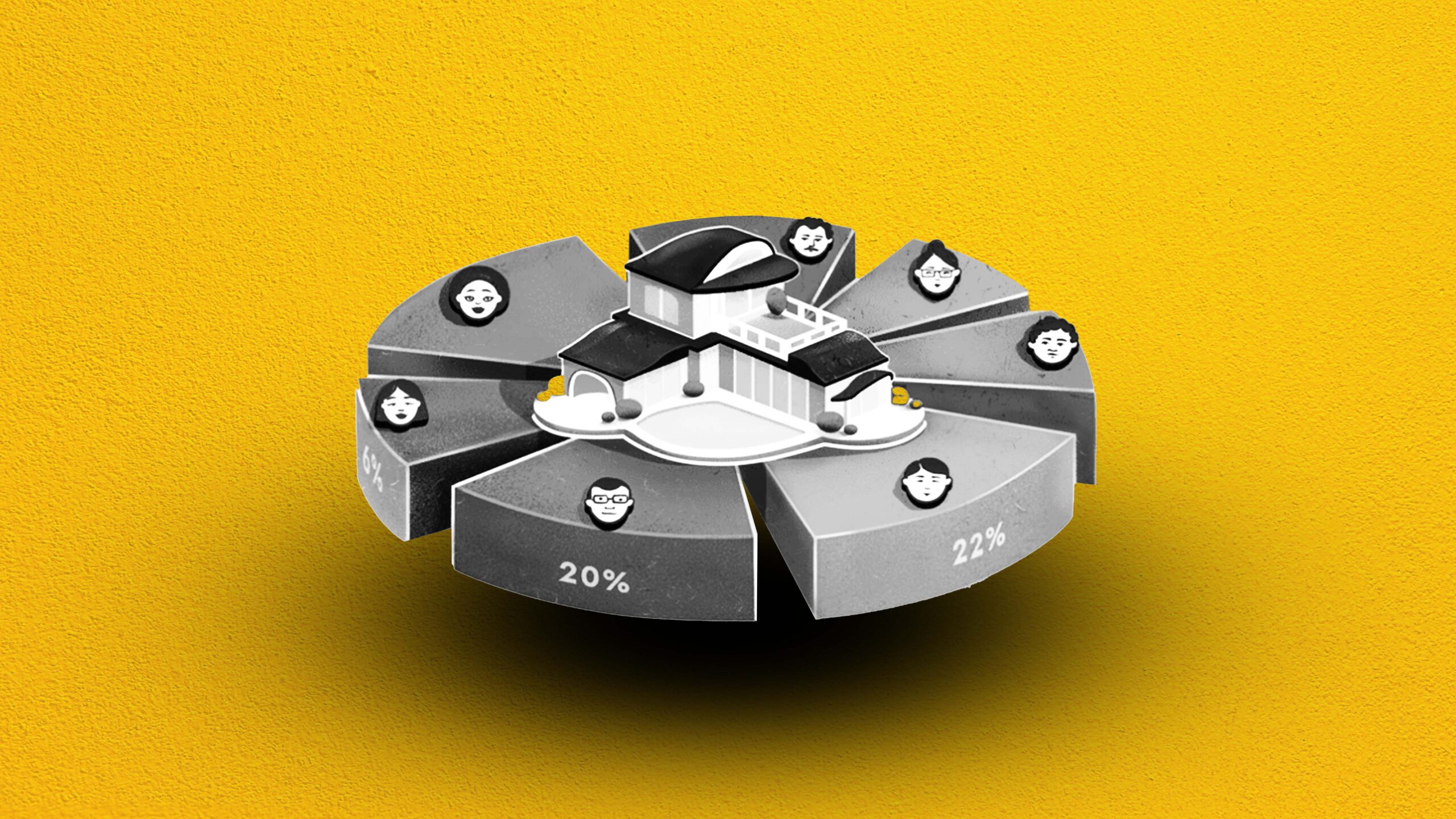

Fractional Ownership

Tokenization allows a project or property to be divided into multiple parts. Traditionally, investment opportunities were only available to institutional investors and the wealthy, requiring high capital. However, real-world assets tokenization enables fractionalized investments, lowering the barrier to entry for retail investors. A global pool of investors can now collectively invest in renewable energy projects within seconds.

Security

One of the main features and benefits of blockchain technology is its security, immutability, and irreversibility. On-chain transactions cannot be tampered with or altered. Moreover, the decentralized nature of the network allows investors to trust the integrity of their holdings, knowing no central entity controls their data, money, or tokens. Blockchain’s transparency also reduces the risk of fraud in the tokenized renewable assets industry.

Use Cases of Real-World Assets Tokenization

Stablecoins

Stablecoins represent one of the largest tokenized markets. These are cryptocurrencies whose value is tied to another currency, commodity, or financial instrument. Some of the most popular stablecoins are pegged to the United States dollar, such as Tether (USDT) and USD Coin (USDC). These stablecoins always hold a value equivalent to one dollar.

The U.S. dollar-backed stablecoin market is reported to be the first large, liquid, tokenized RWA market. Data shows that the stablecoin market capitalization is over $164 billion, according to CoinMarketCap.

Tokenized Real Estate

One frequently discussed example of an asset that can benefit from real-world asset tokenization is real estate. Forbes reported that the real estate tokenization market size was $2.7 billion in 2022, with growth projections indicating it could reach $16 trillion by 2030.

A real estate property can be tokenized and brought on-chain by dividing it into fractions and coding the operational process using a smart contract. Smart contracts are computer programs that automatically execute events according to the terms of a contract or agreement. The property can be divided into as many bits as the owner desires, and the tokens can then be purchased by various investors worldwide.

Renewable Energy Investment Platforms

With the impact of climate change evident, many countries have pledged to reach net-zero carbon emissions by 2050, creating market opportunities in the renewable energy sector.

Tokenized renewable assets involve converting renewable energy projects, like solar or wind farms, into digital tokens on-chain. Tokenization allows investors with limited capital to partake in renewable energy investing and contribute to combating climate change.

Unlike traditional assets, tokens are easily bought or sold, improving liquidity and offering flexibility in managing investment portfolios. Investors can diversify their portfolios by purchasing multiple tokens in different projects, potentially increasing their revenue streams. Tokenization can also drive the widespread adoption of sustainable projects.

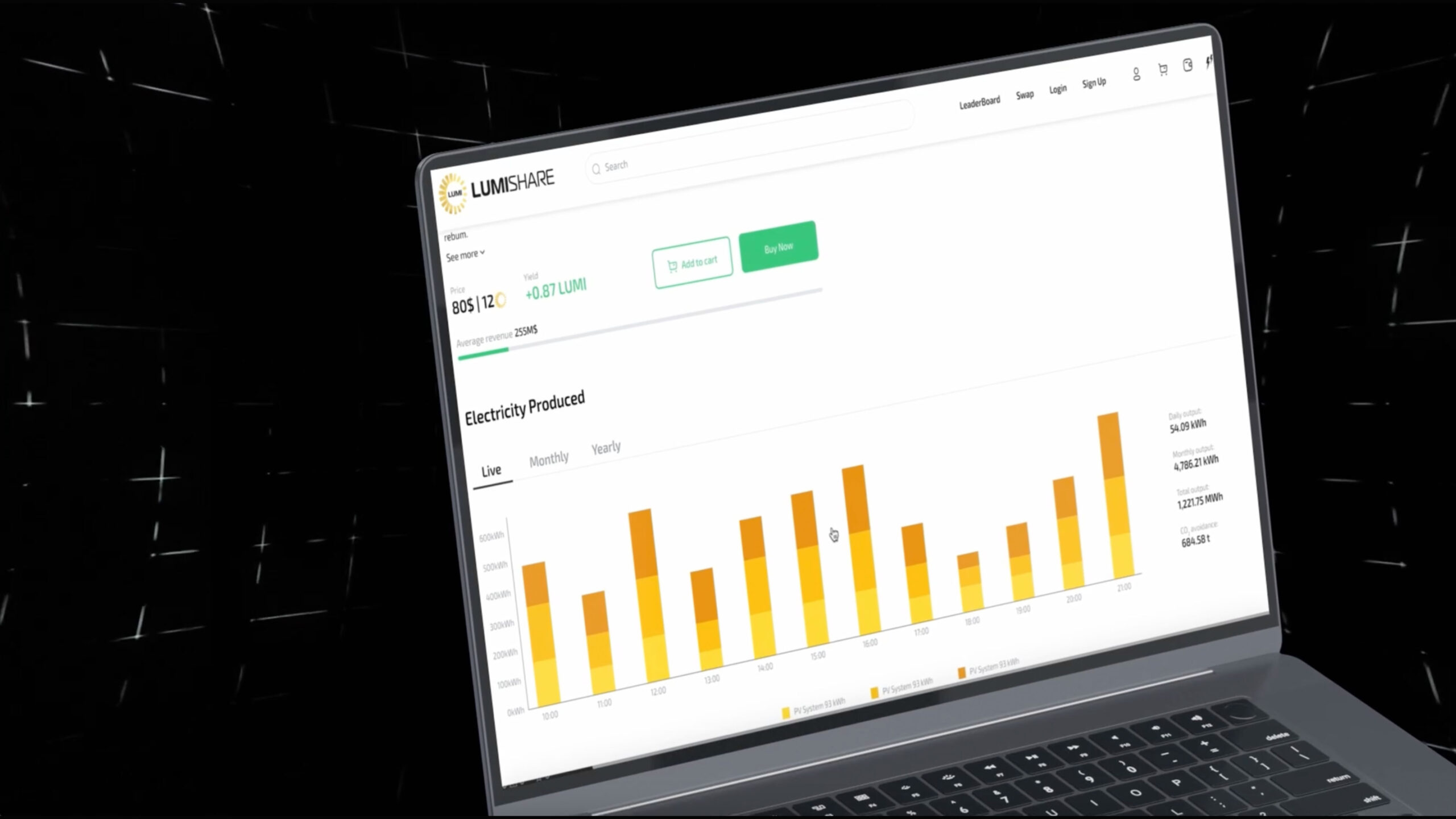

LumiPlace

LumiPlace is one of the leading renewable energy investment platforms. By reviewing each project, tokenizing assets, and complying with local regulations, LumiPlace provides investors with a secure investment platform.

LumiPlace conducts due diligence on all projects, ensuring they meet the minimum requirements for listing on the platform. By meticulously reviewing each project, LumiPlace ensures all renewable energy projects are eligible for tokenization.

What sets LumiPlace apart from other renewable energy investment platforms is its key benefits and features. By tokenizing green projects, LumiPlace democratizes access to investment opportunities.

Tokenized renewable assets also lead to diversification, a crucial strategy for successful investing. Investing in multiple renewable energy projects in different locations through LumiPlace helps investors mitigate risks and potentially achieve higher returns on investment.

Due to ease of access, affordable entry points, and increased liquidity, LumiPlace offers all investors opportunities to participate in environmental impact investing and renewable energy projects.

What strategies can investors adopt for successful green energy investments?

Investors can adopt several strategies for successful green investments, such as:

- Investing in a mix of renewable energy projects across different locations and technologies to spread risk.

- Utilizing renewable energy investment platforms such as LumiPlace offers access to diverse projects and provides transparency and data-driven insights.

Frequently Asked Questions (FAQs)

What is real-world assets tokenization?

Tokenization is the process of creating a digital representation of a real-world asset on a blockchain. This allows the asset to be bought, sold, and traded more easily and securely.

What are real-world assets (RWA)?

Real-world assets are tangible and physical items that are tokenized to be used on a blockchain. These can include real estate, commodities, collectible art, and sustainable energy projects.

Why is tokenization important for renewable energy projects?

Tokenization makes renewable energy projects more accessible to a wider range of investors by lowering the barrier to entry and improving liquidity. This can help drive the adoption of sustainable projects and combat climate change.

What are the benefits of real-world assets tokenization?

The benefits include increased liquidity, fractional ownership, and enhanced security. Tokenization allows more investors to participate in investment opportunities and provides greater transparency and trust through blockchain technology.

Can anyone invest in tokenized assets?

Yes, tokenization lowers the barrier to entry, allowing both institutional and retail investors from around the world to invest in tokenized assets. This democratizes access to investment opportunities and enables a broader pool of investors to participate.

How does LumiPlace ensure the security of its investments?

LumiPlace conducts due diligence on all projects, ensuring they meet the minimum requirements for listing on the platform. The platform also complies with local regulations and uses blockchain technology to provide secure and transparent investment opportunities.

Disclaimer: This guide is for informational purposes only and should not be construed as investment or financial advice. Always seek professional advice before making any investment decisions.

Leave a Comment